An introduction to Neurashi: unlocking AI to crypto

While the strides of AI have issued dramatic breakthroughs in different industries recently, greater complexity in AI systems still has led us to increased mystery over their internal workings. Neurashi is purposed to bestow credibility upon AI processes, introducing PoI mechanisms and the aggregative approach …

Coming BIG, but where’s the hitch?

With the remarkable strides of artificial intelligence (AI), dramatic breakthroughs in healthcare, finance, transportation, and military industries have been noticeably increased in the recent era of technology. Yet, greater complexity in AI systems still leads to increased mystery over their internal workings, and without effective methods in place, the ramifications of inaccurate or manipulated results could be perilous. Addressing this uncertainty is crucial in validating AI outputs’ authenticity and ethical compliance.

In response to this imperative need, we introduce a rigorously devised decentralized framework, called Neurashi, purposed to bestow credibility upon AI processes. Neurashi’s innovative solution marries the transformative attributes of blockchain technology with a strategically developed crypto-economic reward system in the center of which are specialized AI agents responsible for meticulously assessing the results derived from diverse AI models. This system capacitates stakeholders across various sectors to methodically determine the reliability of AI-generated results. It does so by leveraging a far-reaching network of Critics committed to driving coordinated validation efforts.

This trailblazing framework champions transparency ensures censorship resistance and instills objectivity across the validation paradigm by pooling the expertise of a comprehensive array of independent validators.

So Neurashi’s contemporary and steadfast AI blockchain framework galvanizes the nexus of artificial intelligence (AI) with the robustness of blockchain infrastructure and integrates an innovative crypto-economic incentive system to foster and sustain the construct of trust and credibility.

How does Neurashi solve the mystery?

As claimed before, by pooling the expertise of a comprehensive array of independent validators, Neurashi’s framework champions transparency ensures censorship resistance, and instills objectivity across the validation paradigm whose foundation rests on the Binance Smart Chain blockchain, providing an immutable, transparent ledger tailored to the stringent record preservation requirements.

The validation of one AI model by another necessitates a sophisticated multimodal framework transforming varieties of outcome modalities — such as text, images, videos, and audio — into comprehensible “code.” This code becomes a benchmark for a network of “miners” conducting their validation processes requiring minimal computational. The alternative would be a flood of repetitive results from numerous models, compared and collected for a consensus, needing a laborious cross-referencing method to affirm the validity of results.

A remarkable solution emerges out of the possible answers, forming a system promoting inclusivity where anyone could become a miner, validating a specific type of output.

By revolutionizing adaptive Large Language Models (LLMs), the Neurashi platform has successfully established a system exclusively crafted for inspecting and validating AI model outcomes. This remarkable accomplishment fosters a new direction with a tool that not only affirms the reliability of results but also quantifies the precision score between 1 to 10, marking significant progress in AI and its numerous applications.

So, as a vanguard in its field, Neurashi embodies how the synergy of decentralized tech principles and cryptographic economic incentives can nurture a unique degree of confidence in AI systems.

Incentivization?! Is that so necessary to bring up PoI?

The rise of artificial intelligence (AI) has undoubtedly brought transformative changes across various sectors. Nevertheless, this widespread application does not come without significant challenges — most notably, finding the balance between trusting AI’s capabilities and maintaining a keen eye on its performance. Trusting AI unconditionally and unrestrictedly can result in significant uncertainties without a comprehensive framework to ensure rigorous assessment and validation of its outputs.

So, be the affirmation of the accuracy and reliability of AI-generated results a crucial matter, challenging these results via a process of replication is a key requirement for this validation process. In this case, blockchain technology may offer a strategic solution to striking a balance between trusting AI and keeping its performance in check. Integrating AI’s operations within the structure of blockchain could lead to a more synchronized and seamlessly functioning system in which each AI model — from conception to execution — operates under the persistent scrutiny of its blockchain counterpart. The crucial aspect of this blockchain-AI synchrony is the solution it offers to the issue of replicability.

In search of a solution to ensure the authenticity of AI-generated outputs, we tap into the promising potential blockchain technology, embodied in On-chain Language Models (LLMs). These LLMs form the backbone of our decentralized system. By revolutionizing adaptive Large Language Models (LLMs), the Neurashi platform has successfully established a system exclusively crafted for inspecting and validating AI model outcomes.

The combined judgments of individual Critic LLMs are recorded on the blockchain, fostering transparency and democracy in the validation process. The accumulated scores emanate an aggregated authenticity rank, transcending individual biases to achieve a globally reliable AI conclusion. Such a signifies the emergence of Proof of Intelligence (PoI) where AI models and human validation collectively confirm AI outputs, a concept that resonates with blockchain’s distributed consensus protocol.

So just let it perform on blockchain and leave everything to it?

As these technologies progress further, the need for a transparent, replicable, and completely independent, as well as secure verification mechanism, becomes critical. Harnessing the confluence of AI and blockchain is a potential transformative pathway toward validating and governing AI models in a more efficient and trustworthy context.

Also, the relentless march of time reveals the ever-growing monopoly of large corporations over our digital lives whose dominance is now shaping our online encounters and interactions and even influencing our thoughts. So, a retreat from centralized control and a shift towards a decentralized system — an ecosystem devoid of singular corporate dominance, is the vision that echoes the ethos of cryptocurrencies and blockchain, where authority is distributed amongst a network of participants who encompass both creators and users.

In the case of AI applications, this decentralization can occur through the ability to use Large Language Models (LLMs) to provide solutions, or curate tailored AI Models to cater to the diverse needs of others. This evokes trust, independence, and mutual benefit — premises that are central to blockchain technology (Narayanan et al., 2016).

The fusion of these two possibilities paves the way to a novel model, contributing towards a collective effort to produce authentic AI-generated outputs while reaping individual benefits. This synchrony of personal and collective goals manifests the underlying principles of Proof of Intelligence (PoI).

Harnessing the principles of blockchain and AI, our present society stands at the edge of the birth of a digital world that fosters prosperity through trust, authenticity, and harmonious collaboration.

How about a native token? Say like… NEI?!

Neurashi has provided users with different incentivizations such as a new native token called $NEI that lets you claim rewards for becoming miners while keeping the trust scores of the network up to the highest by validating the AI models’ performance. On the other hand, more products are introduced now such as the ChartMind which interprets and analyzes images, with a special focus on market charts; or the TVA with the ability to meticulously analyze the current market chart to provide dynamic feedback. There is also the ChainCoder that will easily help you create your own smart contract without needing to know even a single coding phrase.

With the further progression of our project, we are eager to announce that the most recent update of Neurashi’s tokenomics has been published on our website.

According to the above-mentioned document:

- 15% of NEI’s total supply is allocated to the Team in the following contract address within a 5-year vesting program including a 1-year cliff: 0x4A1D24106F457fd3533deee5403a71Cf8d0098b2

and unlocked into the following multisig wallet:

0xe279cCf4510b983b20Ce428843deC7a5C9aBa741 - 5% of the total supply is allocated to Advisors and Partnerships in the following contract within a 2-and-a-half-year vesting program including a 6-month cliff:

0xd1926C4813Cd3b65Bc9ccc24CAE72695fC245e1b

and unlocked into the following multisig wallet:

0x0b6705686931D03A6BF51B358cdb8Ba04bD98C12 - 15% of the total supply is allocated to Marketing and Community in the following contract within a 2-year vesting program including a 1-year cliff:

0x0eBf42279a8ee6BD11bab993Cba7C39d9Aa91088

and unlocked into the following multisig wallet:

0x39ea37819b5E974d0406b0C375Be736a4c11f53b - 15% of the total supply is allocated to Liquidity and Exchanges in the following contract within 1 year and 4 months of a vesting program:

0xFcD1014E6E136469c38D168aF035f1478622FAD6

and unlocked into the following multisig wallet:

0x213042E153dd781eb183BC53E2E09d4C7edB151a - 10% of the total supply is allocated to the Development Fund in the following contract with 5% being released initially and held within the team and 5% released instantly after a 1-year cliff:

0xDE8cFc11E276430021E1D0d6DC7c15D312fB5417

and unlocked into the following multisig wallet:

0x8aA9553C92ce68fE683A01A5bD26262AE7743e97 - 20% of the total supply is allocated to Ecosystem Growth in the following contract within a 3-year vesting program including a 6-month cliff:

0x66F636228C1cc7459d0aa4Cb16637FAa56aE743F

and unlocked into the following multisig wallet:

0x6203481410bC9C033aFd14Fce2a95AD0b604d005 - 10% of the total supply is allocated to Staking and Rewards in the following contract within 1 year and 3 months of a vesting program including a 3-month cliff:

0x22b5b51834Bf3417ADE217cD798E40E359E754cb

and unlocked into the following multisig wallet:

0x76D0DFE3B4CcF0684A478C16A87f41C67F64E209 - Finally, 10% of the total supply is allocated to Private Sale in the following multisig contracts within a 2-year vesting program including a 1-year cliff:

1- 0x1317f697e45221BBe964A516E940aB073542E0ca

2- 0xAB8Fc6d6Aa75A14cbE3F601f6587701957aDa20b

3- 0xF53f7F0845540557378FCc378E9Dac86C11458e6

4- 0x3FF9345f2799D887890e1095FF8CCDFDf2A07CDb

5- 0x3D52D028526BCAd1f8967e0b522AfE1eC2CC8202

6- 0x59F7C94f1d52Bb41AB2449e1337443d37f70b8D2

7- 0xC5509b04B56B93492a8726f4C708C2D3e16F8A16

The related timelocks are reached as a result of planning the vestings with the help of Team.Finance. Therefore, the NEI token is now provided with timelock contracts and vesting programs, relatively explained in the implied Google Sheet link:

It is worth mentioning that among the 7 Private Sale wallets, whose holdings are locked and will be released into a multi-signature wallet, there is one address regulated and controlled by the team itself.

Tokenomics

Token Name: Neurashi

Token Ticker: NEI

Total Supply: 45,000,000,000 NEI

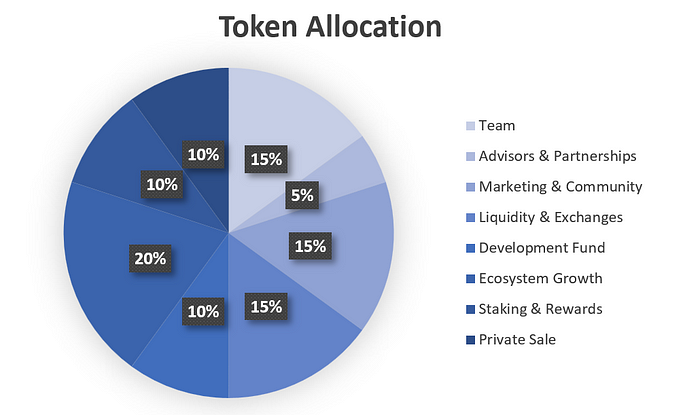

The tokenomics of the NEI token — the native token of the Neurashi network — is described generally in the chart below and is backed by a fully detailed description in the following passages.

Team (15%)

Vesting: 5-year vesting with a cliff period of 1 year.

· Purpose:

Incentivize the core team and developers for further progress.

· Allocation:

6,750,000,000 tokens. (15% of the total supply)

· Tokenomics:

Cliff Year (Year 1):

o At the end of the cliff period (12 months), tokens continue to vest over the next 4 years with equal portions released by the end of each month.

Years 2–5 (Months 13–60):

o Here’s a month-by-month breakdown:

- Month 1 (Beginning of Year 2): 6,750,000,000 tokens * (1/48) = 140,625,000 tokens released

- Month 2: 6,750,000,000 tokens * (1/48) = 140,625,000 tokens released

- …

- Month 12 (End of Year 2): 6,750,000,000 tokens * (1/48) = 140,625,000 tokens released

o This pattern continues for the subsequent years:

- Year 3 (Months 13–24): 6,750,000,000 tokens * (1/48) = 140,625,000 tokens released per month

- Year 4 (Months 25–36): 6,750,000,000 tokens * (1/48) = 140,625,000 tokens released per month

- Year 5 (Months 37–48): 6,750,000,000 tokens * (1/48) = 140,625,000 tokens released per month

• Monthly releases: 1/48th of the allocated tokens are released each month after the 1-year cliff.

Advisors & Partnerships (5%)

Vesting: 2 and a half years vesting with a cliff period of 6 months.

· Purpose:

Reward advisors, consultants, and strategic partners for their contributions.

· Allocation:

2,250,000,000 tokens. (5% of the total supply)

· Tokenomics:

Cliff Period (Months 1–6):

o During the cliff period, no tokens are released.

Months 7–30:

o After the cliff period, tokens continue to vest over the next 2 years, with equal portions released by the end of each month.

o Here’s a month-by-month breakdown:

- Month 7 (Beginning of Year 1): 2,250,000,000 tokens * (1/24) = 93,750,000 tokens released

- Month 8: 2,250,000,000 tokens * (1/24) = 93,750,000 tokens released

- …

- Month 30 (End of Year 2): 2,250,000,000 tokens * (1/24) = 93,750,000 tokens released

• Monthly releases: 1/24th of the allocated tokens are released every month after the 6-month cliff.

Marketing & Community (15%)

Vesting: 2-year vesting with 3% instant release

· Purpose:

Fund marketing campaigns, community building, Airdrops, and user acquisition.

· Allocation:

6,750,000,000 tokens. (15% of the total supply)

· Tokenomics:

Cliff Period (1 year):

o 1,350,000,000 tokens are released instantly for marketing purposes.

o Then, during the cliff period, no tokens are released.

Months 12–24:

o After the cliff period, the rest of the tokens continue to vest within 1 year, with equal portions released by the end of each month.

o Here’s a month-by-month breakdown:

- Month 1 : 5,400,000,000 tokens * (1/12) = 450,000,000 tokens released

- Month 2: 5,400,000,000 tokens * (1/12) = 450,000,000 tokens released

- …

- Month 12 (End of Year 1): 5,400,000,000 tokens * (1/12) = 450,000,000 tokens released.

Liquidity & Exchanges (15%)

Vesting: 16 months vesting with 2% instant release

· Purpose:

Provide liquidity on decentralized exchanges (DEXs) and secure listings on centralized exchanges.

· Allocation:

6,750,000,000 tokens. (15% of the total supply)

· Tokenomics:

• 900,000,000 tokens released instantly for adding liquidity on DEXs and secure listings on probable CEXs

• Monthly releases: 1/16th of the rest (5,850,000,000) continue to vest within 16 months with equal portions released by the end of each month.

- Month 1 : 5,850,000,000 tokens * (1/16) = 365,625,000 tokens released

- Month 2 : 5,850,000,000 tokens * (1/16) = 365,625,000 tokens released

- …

- Month 16 : 5,850,000,000 tokens * (1/16) = 365,625,000 tokens released

Development Fund (10%)

Vesting: 5% is secured in the safe hands of the team for necessary and urgent developments and 5% is locked for 1 year.

· Purpose:

A development fund is created for future development, expenses, and strategic initiatives.

· Allocation:

4,500,000,000 tokens. (10% of the total supply)

· Tokenomics:

o 2,250,000,000 tokens are secured in the safe hands of the team for necessary and urgent developments.

o 2,250,000,000 tokens are locked for 1 year.

Ecosystem Growth (20%)

Vesting: 3-year vesting with 6 months cliff

· Purpose:

Support the growth of the project’s ecosystem, partnerships, and developer grants.

· Allocation:

9,000,000,000 tokens. (20% of the total supply)

· Tokenomics:

Cliff Period (Months 1–6):

• During the cliff period, no tokens are released.

Months 7–30:

o After the 6-month period, monthly releases begin accordingly; tokens continue to vest within 2 and a half years with equal portions released by the end of each month.

o Here’s a month-by-month breakdown:

- Month 7 : 9,000,000,000 tokens * (1/30) = 300,000,000 tokens released

- Month 8 : 9,000,000,000 tokens * (1/30) = 300,000,000 tokens released

- …

- Month 30 : 9,000,000,000 tokens * (1/30) = 300,000,000 tokens released

Staking & Rewards (10%)

Vesting: 15 months vesting with a cliff period of 3 months.

· Purpose:

To Incentivize token holders to stake, participate, and secure the network.

· Allocation:

4,500,000,000 tokens. (10% of the total supply)

· Tokenomics:

Cliff Period (Months 1–3):

o During the cliff period, no tokens are released.

Months 4–15:

o After the 3-month period, tokens continue to vest within 12 months with equal portions released by the end of each month.

o Here’s a month-by-month breakdown:

- Month 4: 4,500,000,000 tokens * (1/12) = 375,000,000 tokens released

- Month 5: 4,500,000,000 tokens * (1/12) = 375,000,000 tokens released

- …

- Month 15: 4,500,000,000 tokens * (1/12) =

375,000,000 tokens released

Private Sale (10%)

Vesting: 2-year vesting with a cliff period of 1 year.

· Purpose:

Private sale to attract funds.

· Allocation:

4,500,000,000 tokens. (10% of the total supply)

· Tokenomics:

Cliff Period (1 year):

o During the cliff period, no tokens are released.

Months 13–24:

o At the end of the cliff period (12 months), the first portion of tokens is released.

o Monthly releases: tokens continue to vest within 2 years with equal portions released by the end of each month.

o Here’s a month-by-month breakdown:

- Month 13: 4,500,000,000 tokens * (1/12) = 375,000,000 tokens released

- Month 14: 4,500,000,000 tokens * (1/12) = 375,000,000 tokens released

- …

- Month 24: 4,500,000,000 tokens * (1/12) = 375,000,000 tokens released

What is up next then?! Another revolution…?

Whilst AI platforms are still raging to emerge and trying to introduce a new way of revolutionizing the world of crypto, Neurashi is also developed to bring more decentralization to the whole characteristics of the cryptocurrency field and make the revolution of AIs emerge in a much quicker manner to help us put a huge step forward into the next generation of technology.

So, if you are asking if it is going to start a revolution or not, well, the revolution has already been started, so we just have to keep it going forward if we are aching for a better world. However, it’s good to know that Neurashi is always going to be revolutionary.

Here you can find the roadmap of the Neurashi project and the future plans of the team for developing and publishing:

Q4–2022

Needs assessment

Forming the initial idea for using AI in blockchain

Creating a core team

Creating a business plan

Q1–2023

Developing Conversational Interactive Language Model (CILM)

The idea of implementing the POI consensus mechanism for Neurashi

Starter Idea of Blockchain Conversational Interactive Language Model (BCILM)

Developing ChartMind V1

Q2–2023

Preprocessing data for ChartMind V1

Starting Development of ChainCoder

Knowing the target market

Designing a user attraction strategy

Q3–2023

Starting Development of BCILM

Team build up

Website design

Finalizing white paper

Meeting with venture capitals and angels to invest in the project

Completing docs on the website

Completing $NEI tokenomics

Q4–2023

Gathering and preprocessing data for Blockchain CLIM V2

Preprocessing data for Blockchain CLIM V2

Training and evaluating Blockchain CLIM V2

Introducing BCILM V2

Preprocessing data for ChartMind V3 (dimension 3)

Training ChartMind V3

Testing and evaluating ChartMind V3

Introducing BCILM

Developing Neurashi X (Twitter) AI to share the latest news and announce our updates

Lunching Neurashi AI in X.com

Gathering and preprocessing data for Blockchain CLIM V2

Introducing ChartMind V2

Gathering data for ChartMind V3

Preprocessing data for ChartMind V3 (dimension 1)

Developing a new multimodal architecture for ChartMind V3

Getting audit for $NEI token smart contract

Deploying $NEI tokens on BNB Chain

Renounce ownership

$NEI listing on CoinMarketCap and Coin Gecko

Private sell

$NEI listing on pancake swap and Adding liquidity to it

Hold IEO/IDO/… on popular exchange

$NEI listing on trust, meta mask, atomic wallets

Developing the new version of the ChartMind AI model (ChartMind V1.5)

Preprocessing data for ChartMind V2 (dimension 2)

Preprocessing data for ChartMind V2 (dimension 3)

Testing the Blockchain Conversational Interactive

Language Model (BCILM)

Training AI model for ChartMind V2

Evaluating ChartMind V2

Q1–2024

Working on the TVA backend

Connecting ChartMindV3 with Blockchain CLIM V2 for TVA V2

Connecting to 3 AI providers for Neurashi

Debugging smart contracts for Neurashi miners

Rechecking Neurashi for testnet

CEX listing

DEX listing

Listing on more wallets

Q2–2024

Preparing Neurashi for testnet

Lunching Neurashi in the testnet

Evaluating Neurashi in testnet

Gathering data for the smart contract coder product (ChainCoder V1)

Testing and evaluating ChainCoder V1

Introducing ChainCoder V1

Q3–2024

Evaluating Neurashi in testnet

Developing and training the LLM model for ChainCoder V2

Designing a new LLM architecture for ChainCoder V2

Gathering data for ChainCoder V2

Preprocessing data for ChainCoder V2

Training and evaluating ChainCoder V2

Q4–2024

Neurashi mainnet launch

Dao voting system for nodes

Where can you find us? Everywhere…!

But if you are looking specifically for our social media accounts, here is a list of the links to our profiles:

LinkTree:

GitHub:

Twitter:

Telegram:

Channel

Group